Reports

At Dotclear, we understand that insightful, accurate, and timely reports are critical for making informed business decisions and maintaining regulatory compliance. Our comprehensive reporting solutions are designed to cater to a variety of business needs, providing detailed insights into your financial health, operational efficiency, and compliance status. Whether you are a startup, SME, or a large corporation, our robust reporting tools help you navigate the complexities of accounting and regulatory requirements effortlessly.

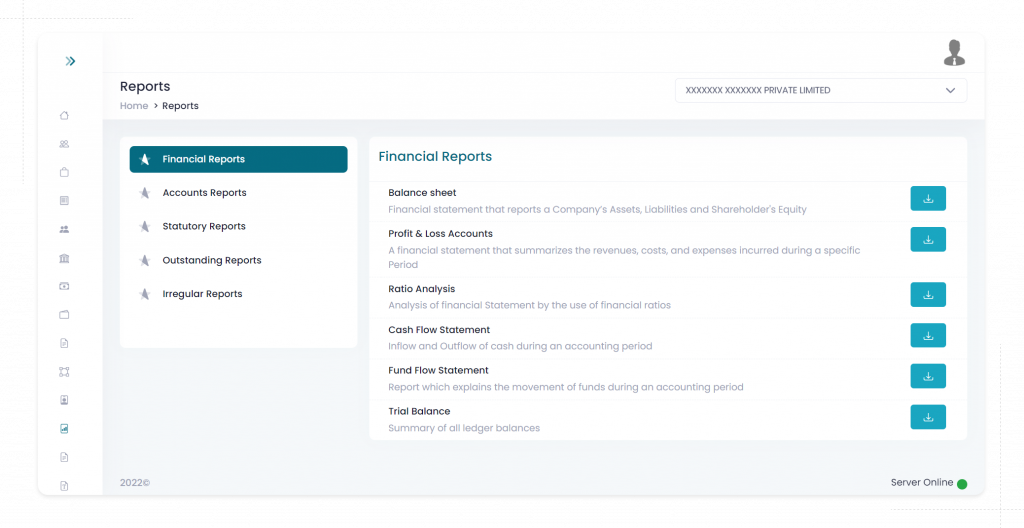

Financial Reports

Balance Sheet

- Description A financial statement that reports a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

- Use: Provides a snapshot of the company’s financial position, showing what it owns and owes.

Profit & Loss Accounts

- Description A financial statement that summarises revenues, costs, and expenses incurred during a specific period.

- Use:Measures the company’s financial performance over the reporting period, indicating profit or loss.

Ratio Analysis

- Description Analysis of financial statements using financial ratios to evaluate performance.

- Use Helps in assessing the company’s operational efficiency, liquidity, profitability, and solvency.

Cash Flow Statement

- Description Shows the inflow and outflow of cash during an accounting period.

- Use: Provides insights into the company’s cash management, showing how well it generates cash to meet its debt obligations and fund its operations.

Fund Flow Statement

- Description A report that explains the movement of funds during an accounting period.

- Use: Helps in understanding changes in the financial position by showing sources and uses of funds.

Trial Balance

- Description A summary of all ledger balances at a given time.

- Use Ensures that total debits equal total credits, aiding in the detection of errors in the ledger accounts.

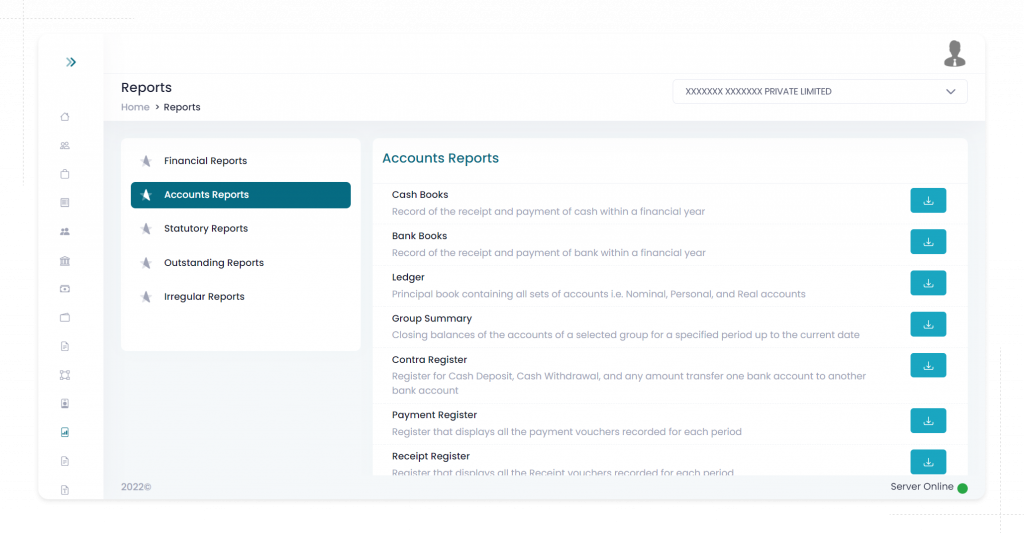

Accounts Reports

Cash Books

- Description: Records of the receipt and payment of cash within a financial year.

- Use: Tracks all cash transactions, helping in cash management and reconciliation.

Bank Books

- Description: Records of the receipt and payment of bank transactions within a financial year.

- Use: Tracks all bank transactions, facilitating bank reconciliation.

Ledger

- Description: Principal book containing all sets of accounts, including nominal, personal, and real accounts.

- Use: Centralises financial data, allowing for detailed tracking and analysis of all financial transactions.

Group Summary

- Description: Shows closing balances of accounts within a selected group for a specified period.

- Use: ovides a summarised view of financial positions for groups of accounts, aiding in financial analysis.

Contra Register

- Description: Register for cash deposits, withdrawals, and transfers between bank accounts.

- Use: Tracks internal transfers, ensuring accurate recording and monitoring of funds movement.

Payment Register

- Description: Displays all payment vouchers recorded for each period.

- Use: Tracks all outgoing payments, aiding in expense management and control.

Receipt Register

- Description: Displays all receipt vouchers recorded for each period.

- Use: Tracks all incoming receipts, assisting in revenue tracking and management.

Sales Register

- Description: Summarises sales transactions and closing balances.

- Use: Monitors sales performance, helping in sales analysis and forecasting.

Purchase Register

- Description: Summarises purchase transactions and closing balances.

- Use: Tracks purchase activities, aiding in expense management and supplier relationship management.

Journal Register

- Description: Displays all journal vouchers recorded for each period.

- Use: Provides a detailed view of all journal entries, supporting thorough accounting record-keeping.

Debit Note Register

- Description: Used to record purchase returns.

- Use: Tracks returned goods to suppliers, ensuring accurate purchase accounting.

Credit Note Register:

- Description: Used to record sales returns.

- Use: Monitors returned goods from customers, ensuring accurate sales accounting.

Day Book

- Description: Captures a day’s entries or transactions.

- Use: Provides a daily summary of financial transactions, supporting day-to-day financial tracking.

Stock Summary:

- Description: A statement of real-time stock-in-hand on a particular date.

- Use: Monitors inventory levels, aiding in inventory management and control.

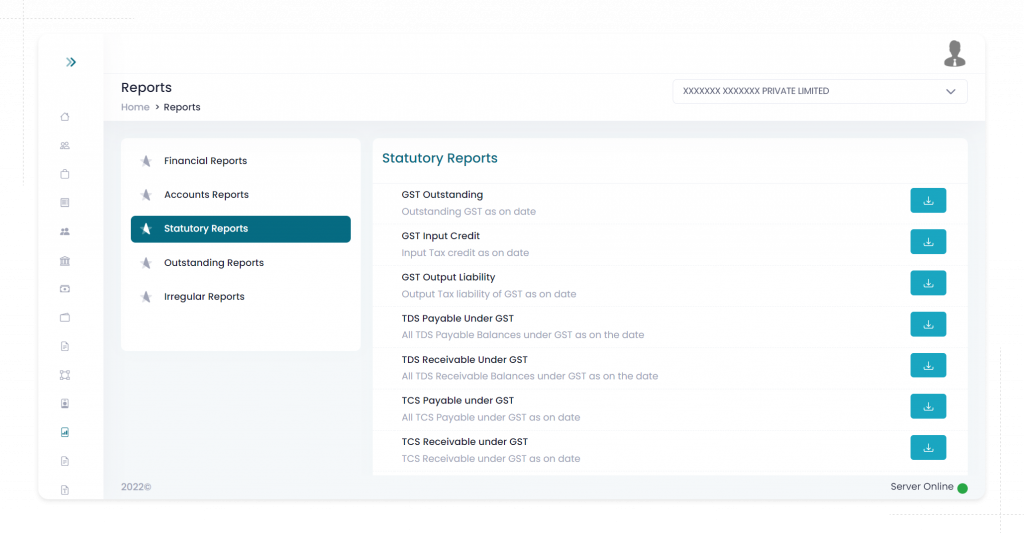

Statutory Reports

GST Outstanding

- Description: Displays outstanding GST amounts as of the current date..

- Use: Helps in tracking GST liabilities and ensuring timely payments.

GST Input Credit

- Description:Shows input tax credits available as of the current date.

- Use: Tracks input credits, aiding in accurate GST filing and compliance.

GST Output Liability

- Description: Displays output tax liability for GST as of the current date.

- Use: Monitors GST payable, ensuring proper tax planning and compliance.

TDS Payable Under GST

- Description:Displays all TDS payable balances under GST as of the current date.

- Use: Tracks TDS obligations, aiding in compliance with GST regulations.

TDS Receivable Under GST

- Description: Displays all TDS receivable balances under GST as of the current date.

- Use: Monitors TDS receivables, ensuring proper accounting and collection.

TCS Payable under GST

- Description:Shows all TCS payable under GST as of the current date.

- Use: Tracks TCS obligations, aiding in compliance and proper accounting.

TCS Receivable under GST

- Description:Displays TCS receivable under GST as of the current date.

- Use: TCS receivables, ensuring accurate accounting and collection.

TDS Payable under Income Tax:

- Description:Displays all TDS payable under income tax as of the current date.

- Use: Ensures compliance with TDS regulations, tracking payable balances.

TDS Receivable under Income Tax

- Description: Shows all TDS receivable under income tax as of the current date.

- Use: Monitors TDS receivables, ensuring proper accounting and timely collection.

TCS Payable under Income Tax

- Description: Displays TCS payable under income tax as of the current date.

- Use: Tracks TCS obligations, ensuring compliance and accurate accounting.

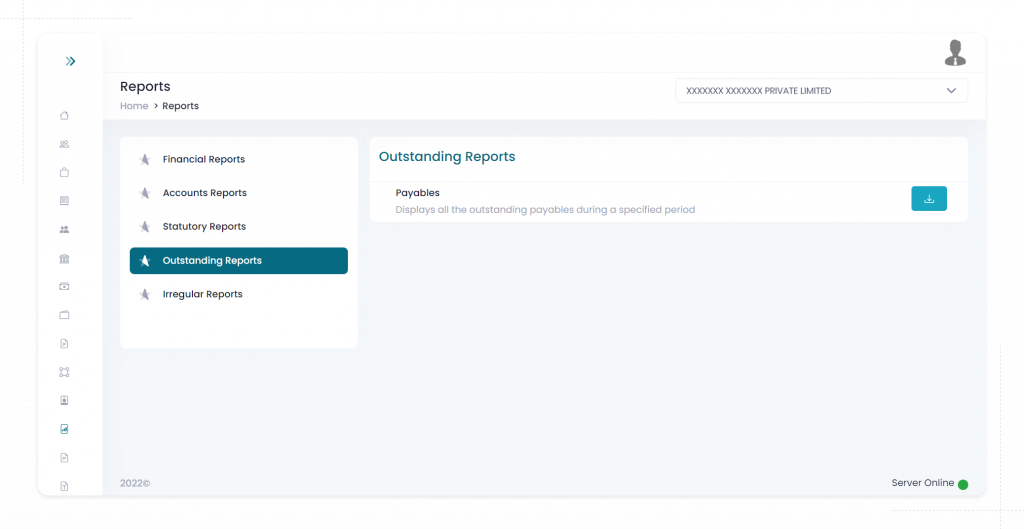

Outstanding Reports

Payables

- Description: Displays all outstanding payables during a specified period.

- Use: Tracks amounts owed to suppliers and vendors, aiding in cash flow management and timely payments.

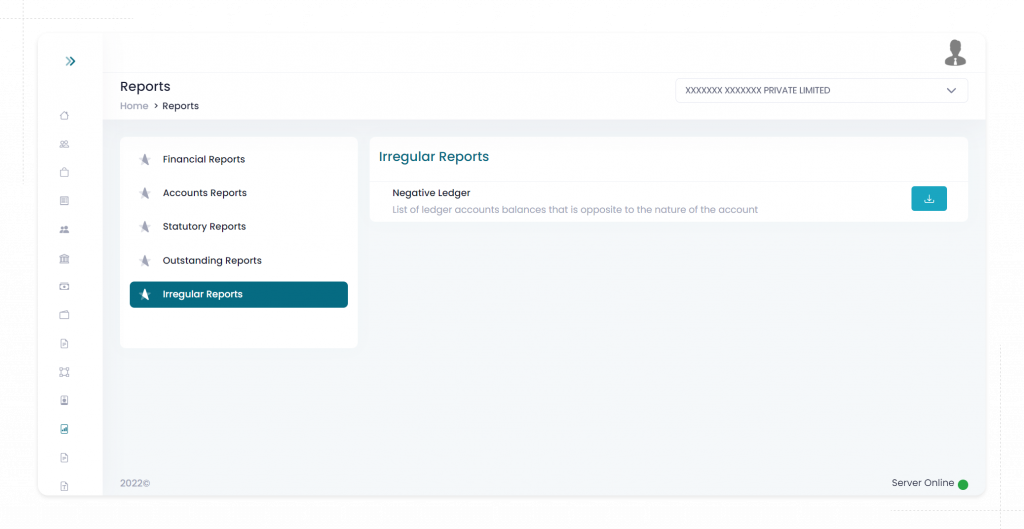

Irregular Reports

Negative Ledger

- Description: Lists ledger accounts with balances opposite to the expected nature of the account.

- Use: Identifies anomalies in account balances, helping in error detection and correction.

Navigate the complex world of accounting and regulatory

compliance like a pro