Compliance

Ensure flawless compliance with our all-in-one software solution. We guarantee 100% adherence to GST, Income Tax, Companies Act (ROC), LLP, and FEMA regulations.

GST Filing

- Filing Returns: Automate the preparation and filing of GST returns to ensure timely compliance.

- Input Tax Credit: Manage and track input tax credits to optimize tax savings.

- Regulatory Updates: Stay updated with the latest GST regulations and changes to ensure ongoing compliance.

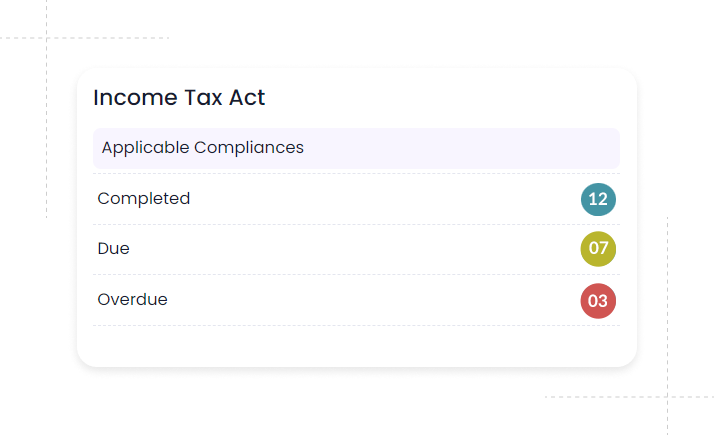

Income Tax Compliance

- Tax Calculation: Automate the calculation of income tax liabilities to ensure accuracy.

- Filing Returns: Simplify the preparation and filing of income tax returns.

- Tax Planning: Provide insights and recommendations for tax planning and optimization to reduce liabilities.

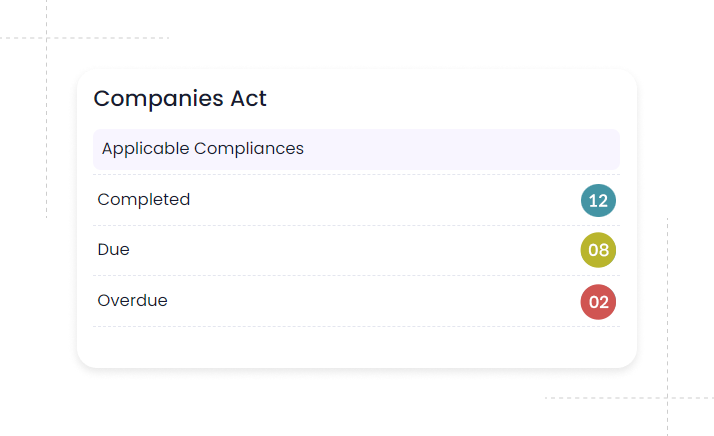

Companies Act (ROC Compliance)

- Annual Filings: Automate the preparation and submission of annual returns and other statutory documents required by the Registrar of Companies.

- Document Management: Maintain and organize all necessary documents for compliance with the Companies Act.

- Reminders: Receive automatic reminders for due dates and compliance deadlines.

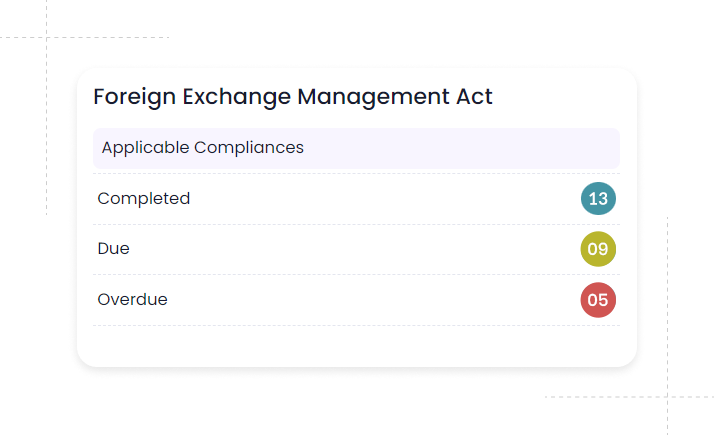

FEMA Compliances

- Regulation Adherence: Ensure compliance with the Foreign Exchange Management Act (FEMA) regulations for international transactions.

- Documentation: Maintain necessary documentation for foreign exchange transactions.

- Reporting: Generate reports to meet regulatory requirements for foreign exchange dealings.

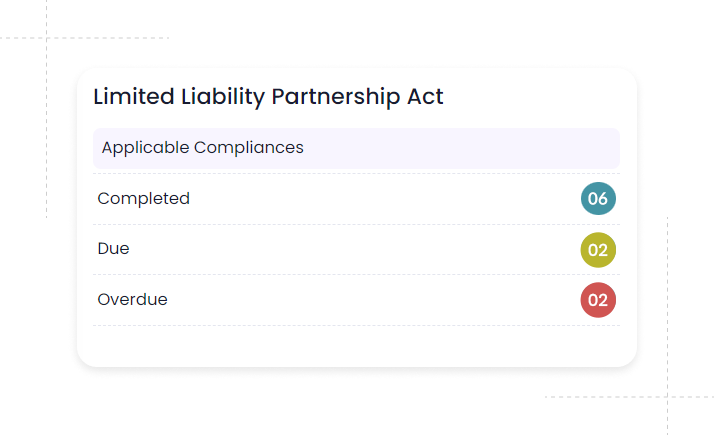

Limited Liability Partnership Act

- Annual Filings: Prepare and submit the annual return and statement of accounts and solvency within the required timelines.

- Taxation and Financial Management: File income tax returns accurately and on time, and conduct audits if the LLP’s turnover exceeds specified limits.

- Partners and Changes: Report changes in partners or the LLP agreement promptly and updates relevant documents.

- Compliance Management and Updates: Maintain organized statutory documents, implement automatic reminders for compliance deadlines, and stay updated on regulatory changes.

Navigate the complex world of accounting and regulatory

compliance like a pro